The tax-free payments for Canada Dental Benefits will depend on the income of your family. Parents and guardians who have children who meet the eligibility criteria are eligible to apply for this benefit.

Benefit amounts are based on income.

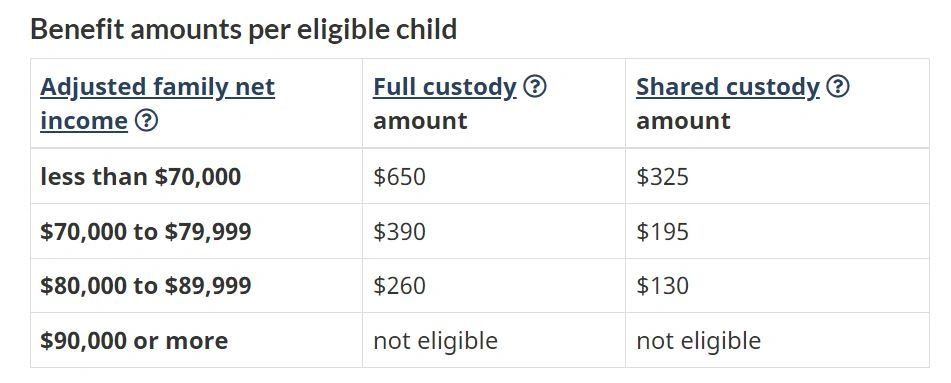

Your benefit amount is determined by the CRA based on your adjusted family net income. The benefit amount for each eligible child will not change based on your dental costs.

How shared custody benefit amounts are split

If your child only lives with you for a short time, you may be regarded as having shared custody for the Canada Child Benefit (CCB). By sharing custody of your child and splitting the CCB, you can receive half of the dental benefit amount.

If both parents are eligible, they can apply for the dental benefit. The amount you receive would be 50% of the benefit amount based on your own adjusted family net income. The amount you receive may be different from that of your child’s other parent.

Benefit amounts are based on income.

Your benefit amount is determined by the CRA based on your adjusted family net income. The benefit amount for each eligible child will not change based on your dental costs.

How shared custody benefit amounts are split

If your child only lives with you for a short time, you may be regarded as having shared custody for the Canada Child Benefit (CCB). By sharing custody of your child and splitting the CCB, you can receive half of the dental benefit amount.

If both parents are eligible, they can apply for the dental benefit. The amount you receive would be 50% of the benefit amount based on your own adjusted family net income. The amount you receive may be different from that of your child’s other parent.

As of now, the dental benefit follows the same custody arrangement as the CCB

- December 1, 2022 for the first benefit period

- July 1, 2023 for the second benefit period

Estimate your Benefit Amount

Please use the following Calculator

Additional benefit if dental costs are over $650

Use this calculator Additional Benefits Calculator

How many payments you can get

Maximum of 2 Payments for each child. If you have more than one eligible child, you can apply all at the same time or separately

You can apply through your CRA Personal Account. If you have no CRA account, please check with us at A&J Tax and Financial Inc. how you can open one.

This blog is for information purposes only, A&J Tax and Financial Inc is not offering these benefits. Please check with CRA.